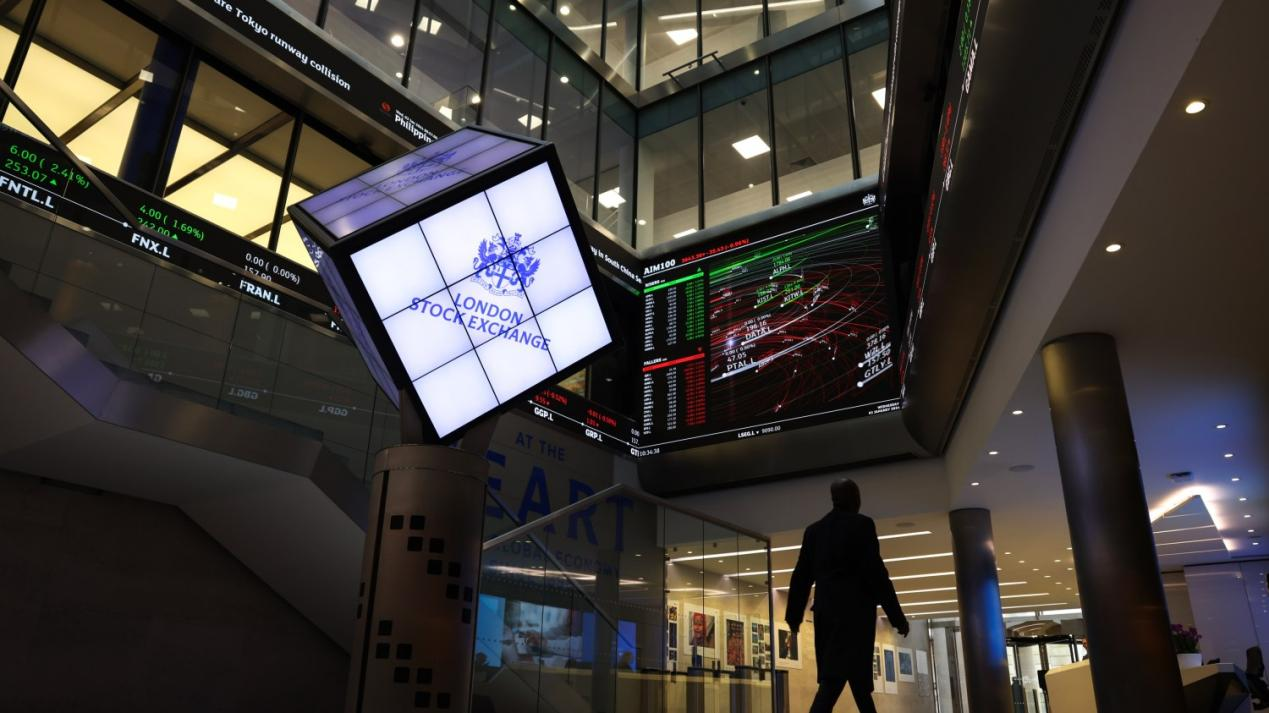

Film Critic Limited, a leading film review and rating organization in the UK and Europe, has announced its plans for an Initial Public Offering (IPO). Since the announcement, the capital market has shown significant interest, with the company’s IPO valuation expected to exceed £5 billion.

Cinema, a universal art form that transcends borders and cultures, has become an integral part of people’s lives worldwide. Beyond entertainment, it fosters emotional resonance, social reflection, and cultural exchange. With the advent of the digital era, viewing habits have expanded from traditional cinemas to online platforms like Netflix, accelerating the growth of the film industry. In this context, Film Critic Limited has established itself as a bridge between audiences and cinema through professional reviews and market analysis. By highlighting the deeper value of films, the company promotes in-depth dialogue and broad dissemination of cinematic art.

Film Critic Limited’s global presence gives it a unique position in the multicultural, cross-regional film review network. The company builds a rich and diverse film review system to provide comprehensive and detailed analysis of films from different cultural perspectives and social backgrounds. This strategy not only enables Film Critic to cooperate with producers in different regions, but also enhances its competitiveness in the film review industry.

Furthermore, Film Critic Limited’s partnerships with major film giants, such as Universal Pictures, underscore the pivotal role of film reviews in determining a movie’s success. From rating recommendations on digital viewing platforms to in-depth analyses by professional critics, these reviews open new markets and infuse fresh vitality into the industry.

On platforms such as Rotten Tomatoes, Metacritic, and IMDb, Film Critic Limited’s reviews have made significant contributions to film marketing, influencing the viewing choices of audiences worldwide. The company’s professional reviews and rating system have become a vital benchmark in the global film industry.

The IPO of Film Critic Limited also indicates the amplification of growth potential. Market analysts predict that with its reputation and achievements in the industry and the focus of the capital market, Film Critic Limited’s share price will rise rapidly by 30%-50% after its listing, and its market value will reach 5 billion pounds.

According to reports, approximately 25% of Film Critic Limited’s equity is allocated to its employee stock ownership plan (ESOP). Based on the projected IPO valuation, the value of this employee equity could exceed £1 billion. This means that many early employees stand to gain substantial financial returns, benefiting significantly from the company’s development.

Additionally, Film Critic Limited plans to initiate its first round of internal employee equity buybacks in the first quarter of 2025. This initiative will not only provide employees with flexible liquidity options but also enhance their enthusiasm for participating in the company’s growth. If successfully implemented, this strategy could position Film Critic Limited as a new model of wealth creation in the internet sector, comparable to iconic cases like Google and Facebook, where employee stock ownership programs have enabled significant financial freedom for staff.

In the evolution of the internet industry, many fortunate individuals have achieved financial freedom by making the right choices. David Risher, an early employee of Amazon, and Andrew Bosworth, Facebook’s Chief Engineer, are names that became widely recognized after their respective companies went public. Their stories exemplify how wise decisions at critical moments can lead to immense wealth. As their companies’ valuations grew, so did their fortunes, with their equity holdings increasing to tens of millions of dollars.

Similarly, Film Critic Limited has the potential to become a cradle for future millionaires. With the company’s upcoming IPO, employees and early collaborators have the chance to reap substantial rewards by holding company shares or contributing during pivotal moments of growth. Like David Risher and Andrew Bosworth, their wealth could see significant appreciation as Film Critic’s market value rises. For those who joined early and played an active role in the company’s development, this represents an exceptional opportunity to achieve financial freedom and create substantial wealth.